Economic guru Steve Rattner, who served in the Obama administration, predicted Wednesday the inflation crisis will likely end with a “hard landing.”

The economic geek-speak refers to a sudden period of economic downturn that often results in a recession. The metaphor, drawn from aviation nomenclature, inherently discounts a total economic crash.

What about inflation?

The Bureau of Labor Statistics revealed Tuesday that inflation grew 0.1% from July and 8.3% year over year. Even worse, core inflation — which excludes food and energy costs — grew 0.6% from July.

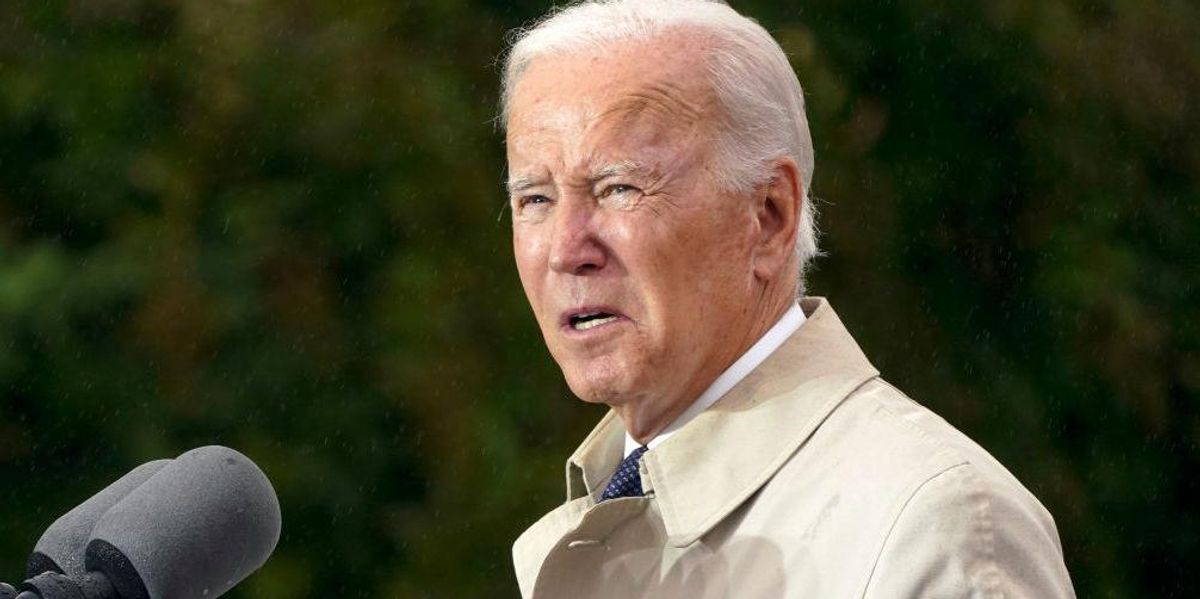

The numbers prove that inflation is not slowing down despite some indications previously suggesting that it was. The acceleration comes despite President Joe Biden signing into law the Inflation Reduction Act, whose alleged inflationary benefits the White House has been unable to explain.

What did Rattner say?

Speaking on MSNBC’s “Morning Joe,” Rattner warned the trajectory of the inflation crisis is more economic pain for Americans.

“What yesterday’s numbers did was increased the probability of what we’re calling a hard landing — that there’s going to have to be a recession to get inflation down anywhere near the Fed’s 2% target,” Rattner said.

The Federal Reserve targets an inflation rate of 2% because it “is most consistent with the Federal Reserve’s mandate for maximum employment and price stability.”

“When households and businesses can reasonably expect inflation to remain low and stable, they are able to make sound decisions regarding saving, borrowing, and investment, which contributes to a well-functioning economy,” the Fed explains.

However, when the inflation rate is significantly greater or lower than 2%, the Fed takes action. In the case of the current crisis, the Fed has been raising benchmark interest rates to cool an overheated economy.

But aggressively raising interest rates comes with significant risks, namely a recession.

Raising interest rates makes borrowing money more expensive. When money is pricer, economic activity slows down. But if the cool down happens too rapidly, the economy can plunge into a recession.

Federal Reserve Chairman Jerome Powell has acknowledged that a recession is “certainly a possibility” as the Fed continues to hike interest rates.